The environmental effects of plastic pollution are immense and pressing. They are articulated by those in the scientific community in a much more nuanced and intelligent way than we could ever manage. But we thought it might be interesting to look at plastics from another perspective: what effect might they have on your portfolio?

In January 2018, China announced that it would stop buying any recycled plastic scrap that isn’t 99.5% pure. Waste exporters, like the US and much of the developed world, scrambled to find new markets. During the first half of 2018, imports of plastic trash increased by 56% in Indonesia; 100% in Vietnam; and 1,370% in Thailand, prompting the country to institute a ban on waste imports.[1]

The US is woefully bad at recycling its own plastic for at least two reasons – it’s difficult and costly. Plastic can only be recycled a limited number of times, and it must be done carefully. Each variety requires a different recycling process. A soda bottle has different melting properties than a lettuce container, meaning they cannot be recycled together. Colored soda bottles cannot mix with clear soda bottles. Milk jugs and yogurt containers must be separated, even though they are both white. Food contamination poses its own unique challenges. The finicky nature of plastic means that hand-sorting is sometimes the only way to maintain purity in the recycling process, which pushes up the cost, especially in developed countries where labor is expensive.[2] Recycling sorting facilities in the US may be forced to slow down in order to adhere to China’s stricter standards. A longer sort time will result in higher costs, which may be passed on to municipalities where leaders will need to make tough decisions about whether recycling is worth the cost.

The environmental hazards of plastic waste are undeniable. According to Science Today, there were approximately 8.3 billion metric tons of virgin plastics produced as of 2015. About 9% of it had been recycled, 12% was incinerated, and 79% was accumulated in landfills or the natural environment.[3] The UN Environmental Program warns that, “unless we take action, there will be more plastic [in the ocean] than fish by 2050.”[4]

The plastics problem will also have stark business and financial ramifications. The predictable suspects – like fast food chains and food and beverage manufacturers – will be impacted. But other industries that may not come immediately to mind will feel the ripple effects of regulation as well. Several major plastic-exporting countries, including the U.K., Germany, and France, have already moved to curb their waste production, and the European Parliament voted to ban single-use plastics like straws, plates, and cutlery by 2021.

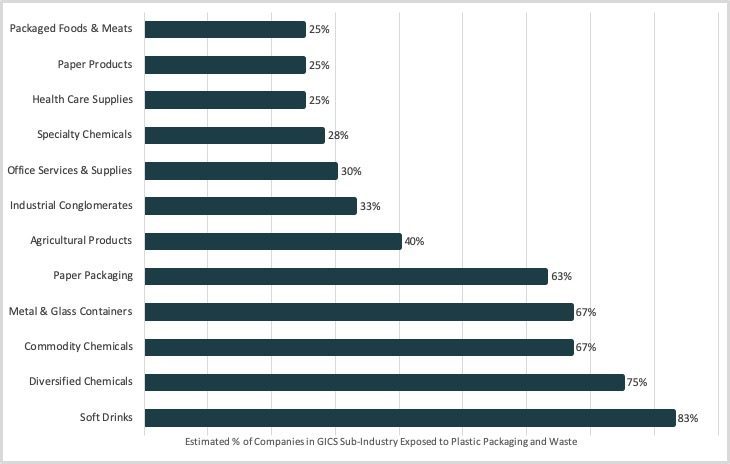

To put the plastics problem into perspective, the investment research firm MSCI (Morgan Stanley Capital International) took an inventory of the 2,450 constituents of the MSCI USA Investable Market Index, which is designed to measure the performance of the large, mid, and small cap segments of the US market. The research team identified as many as 12 relevant industries potentially exposed to malfeasant waste. The estimated percent of companies in the 12 industries that will be exposed to plastic packaging and waste regulation are included in the chart below:

Companies that adapt to the environmental and business risks posed by plastic waste will be the ones least likely to experience negative effects to their bottom line. In turn, investors who seek out companies that respond quickly and responsibly to curb their plastic use are likely to have more consistently profitable portfolios. Already, there has been an uptick in revenue for companies in the Container and Packaging industry of the MSCI ACWI Index (an index which is designed to capture a worldwide sampling of equity returns) that make a majority of their revenue from innovative paper-based packaging solutions. Since 2016, all companies in the index with sustainable packaging solutions have seen a steady increase in their quarterly revenue; all of their peers who focus on plastic-based packaging solutions have seen a corresponding decrease in revenues.[5]

How companies deal with plastic waste is no longer a marketing gimmick or a “feel good” story to put into an annual sustainability report. Investing in and developing innovative non-plastic packaging solutions has become a business imperative and – for the savvy investor – an imperative for the portfolio as well.

[1] MSCI Research Insight. “2019 ESG Trends to Watch.” January 2019. https://www.msci.com/documents/10199/239004/MSCI-2019-ESG-Trends-to-Watch.pdf

[2] Parker, Laura. “China’s ban on trash imports shifts waste crisis to Southeast Asia.” November 16, 2018. https://www.nationalgeographic.com/environment/2018/11/china-ban-plastic-trash-imports-shifts-waste-crisis-southeast-asia-malaysia/

[3] Geyer, Roland; Jenna Jambeck and Kara Law. “Production, use, and fate of all plastics ever made.” July 2017. http://advances.sciencemag.org/content/3/7/e1700782

[4] UN News. “FEATURE: UN’s mission to keep plastics out of oceans and marine life.” April 27, 2017. https://news.un.org/en/story/2017/04/556132-feature-uns-mission-keep-plastics-out-oceans-and-marine-life

[5] MSCI Research Insight. “2019 ESG Trends to Watch.” January 2019. https://www.msci.com/documents/10199/239004/MSCI-2019-ESG-Trends-to-Watch.pdf